Topic 1 => Creating Wealth Through Alternate Sources of Income – 16th Aug 2020, 3.30 – 4.30 pm IST – Free session

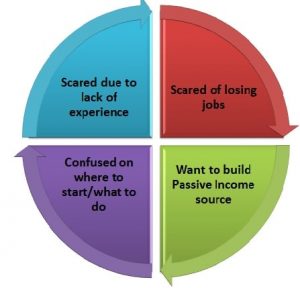

Do you relate to any of these points:

- Scared of losing your job? Worried about bills and EMIs?

- Want to start something of your own / build passive income sources – but don’t know how?

- Looking to retire early and rich?

- Looking for ways to create wealth?

- Tried googling, got lots of answers? Confused about where to start and how to implement it?

- Suffered/Scared of failures in starting something due to lack of experience?

- Want to create income sources different from traditional ways like MF/Stocks?

- Ever wished that you had someone who had already done it, knew things and could offer you advice on how to proceed?

If yes, then you need help my friend. And you have come to the right place!

We are launching Financial Freedom Education Series. It is a powerful series to help you achieve your desired goals with practical advice and experienced guides.

As part of the series, we have planned our first webinar on Creating Wealth Through Alternate Sources of Income. Learn multiple avenues other than stocks and MF to diversify your sources of income.

Session Details

When & Where => Webinar on Sunday, 16th Aug 2020 from 3.30 pm to 4.30 pm IST

Hosted by => Ameet Parande | Nishant Gupta | Kedar Phadke

Fees => Free! Session fees is waived off as part of Independence day Celebration

Suitable For => Everyone

Knowledge required to attend this session => Basic information about concepts like inflation, interest rates, assets and liabilities etc

How to register

Drop a mail on hello@savemoremoney.in . We will inform you when next session is scheduled.

Why attend?

Financial Freedom journey is a tough one. Most do not understand the tricks and keep failing at similar pitfalls.

They think they are smart and can manage everything via the expert gyaan given by Google. However, with time, most such people lose interest once their money shows less than anticipated returns. They return back to FDs, Savings Accounts, or maximum SIP/Stock markets to make money.

Few smart ones however ask for help. They do not mind paying a little to secure a peaceful future. But the problem they face is how to find the right guy for help. You may get hundreds of results via google but won’t know who is best for you.

This is where we come into picture!

Who are we

We are a bunch of individuals who have walked the talk. We have invested in different avenues and identified offbeat investment sources for passive income.

Basis of our experience, we have also been sharing our knowledge with others in the form of training sessions, blogs, webinars, etc.

How are we different

There are lots of people out there who give knowledge on Personal Finance. We are different from them due to the following reasons:

- We offer you a free counseling session to understand your needs

- We educate you on niche topics like Investment in Overseas Properties, Partnering for business opportunities, Creating alternate sources of income, the process to set up Franchise, Forms of business ownership, etc

- Our relationship does not end here. We will support you to get connected with the right people after training

- We offer unique ways to generate alternative income – This will help you quickly achieve your goal of financial freedom

- Community – Over time, you will be a part of our community that will nurture you in the area of Personal Finance.

- Help you become a potential investor/sleeping partner in someone else’s idea

Testimonials

Ameet, you had given extremely informative session on Finance. Thank you so, much Ameet for making us financially literate by providing such an interesting and productive session.

Dhananjay Randhavan

I really enjoyed in this because you have covered each and every topic about finance for example gst, mutual funds which was totally grey area for me, such a gracefully. You always ask question, and provide answer also with elegant way, listen argument, questions from attendees.

Good to see you as enthusiast in such area!!

Senior Software Engineer

Barclays Global Service Centre Private Limited

Thank you very very much Ameet for all your sessions that you have taken and I have privileged to attend! I have learned from those sessions it has helped me in my day to day life especially the personal finance and MFs one. That session gave me the real picture of the behavior if the average or I should say 80% of people in this world have and people thinks that it’s very difficult. And because of your session it cleared all my understandings and gave me a good picture that how can we achieve the financial freedom in our life. I liked the facts you explained about the financial pyramid very much. I always had this belief that a good teacher is the one who can share and transfer his knowledge to his students 100%. And you are one of those artist whom I have been seeing doing it quite easily.

Gopal Patil

Senior Software Engineer

Nuance India Pvt Ltd

The session helped me immensely to gain knowledge on personal finance. I was a complete novice when it came to managing/ saving/ investing money.

Akshay lele

The session had lots of scenarios that acted as an eye opener towards effective money management.

On top of it Ameet has an incredible gift of explaining the things in a very simple way. The concepts of inflation, compounding where explained in detail.

Ameet was successful in convincing the below to me…

Whatever be your salary you will never have money to invest unless you start saving for investing with your current salary.

I would highly recommend this session

Lead Software Engineer

Tieto Software Technologies Pvt Ltd

I could say that I had almost zero understanding of how to evaluate health of our personal finances before I attended Ameet’s session. The clarity with which he explained the concepts of compounding, long term view of investment and comparison Mutual funds / Equity with other asset classes really made me rethink and learn more on this topic. Furthermore – why it is a must to have term-life-insurance, personal health insurance (on top of the one company provides) even before thinking about investment and what is the power of “good EMI” i.e. SIPs. So much influence his session has had on my way of thinking is that, I switched from regular plans to direct plan in mutual funds in few weeks and have become avid reader to keep myself updated on newspapers, books and journals on personal finance. One of the book he suggested “Millionaire next door” make us understand what is the difference between ‘looking rich’ and ‘being rich’. The un-biased opinion and guidance that Ameet gives is simply great and I am glad that I could attend his session. Looking forward to attend the new session that he is takes now to covers more topics related to personal finance beyond conventional investments.

Sriram Kulkarni

Senior Bid Manager

Tieto Software Technologies Pvt Ltd

Financial Planning is one among the most neglected thing which must have to be at the top of our priorities. The Financial Planning, gives us stability, peace of mind, and calculative risk taking ability to get the best out of the market. It is very difficult to keep ourselves updated with the latest changes in policies, changing rules and various new opportunities, even if we have the basic knowledge of it. I thanks Ameet, for introducing it to me. I really appreciate his knowledge and his passion to make people financially strong and also his eagerness to update, learn and share more and more knowledge in this field. Not only, he helped many in understanding the financial instruments, but he gives his personal suggestions with proper justifications and examples, for the proper guidance. Apart from that, various discussions, puzzles and quizzes, initiated by him, help us to remember even the minute things in addition to just knowing them. He gives us the proper inside to differentiate what is shown to us in the financial market and what to see out of it. I would strongly recommend him to anybody who is willing to be financially sound but not getting the sufficient time, motivation or knowledge for the same. And of-course, his availability to respond to all the questions fired to him on which ever portal, makes him the best choice. Thanks Ameet for your guidance.

Swastik Jain

Senior Software Engineer,

Tieto Software Technologies Pvt Ltd

I started my journey some 10 yrs back (oh yes, I have grown old). He introduced me to Mutual funds. I was sceptical. We both, me and my friend, started with two MFs with our SIP amount being 1K for each MF.

Praveen Jaiswal

It wasn’t making sense to us back then. I even wanted to get out of it as I had to maintain balance in my account and I was afraid if I don’t pay one installment , I will lose all my corpus. But our enlightening continued. We started getting basics of investing. And after next appraisal I was invested in 3 MFs with my total invest per month standing at 6K.

Time started flowing, like it does always, even at this moment. After another year or so, I got married. We started our own family and welcomed our son to this world 2 years later. The small amount that i kept investing every month made a huge impact on my savings. I had accumulated close to 4L in savings from MFs. It came so handy when I was buying my first (and only ) house.

Since then there has been no looking back. I still remember his first words when he started giving us financial lectures, “Start small , start young”.

I am so thankful to him for giving me right guidance and direction when it was needed the most. I owe a lot to him for my current financial freedom (if I can call it that).

And best part about him is , he constantly try to enrich his knowledge. He is really mean in this department and lays his hands on almost every information available. He can not only guide anyone on how to do investment, but also on what health insurance to buy, why critical illness cover is good or bad, what is asset and how you can make more money by getting invested and much more.

He is my one stop solution for all finance and investment related queries.

Bless you Ameet !!!

QA Manager

Promobitech software Pvt Ltd

Perfectly articulated article covering niche segments which usually people tend to skip!

Bharti

Very nice. I think Nishanth can do every single one of the 11 above. Seriously, these are things that very few might have thought about. Very apt for these hard-to-find-work days

Sudhakar Majety

Hello Nishant! Superb explanation! Educating as a text book! Would love to share it. Zafar

Zafar

1) Graphs, Stats, examples to create a sceario 2) Day to day life conversations to make it intresting. 3) Detaild strategy for investing. 4) Mackbook— A attached dream to encompass all.

Vinayak

5) Simple approach and without heavy Jargons. Well done. Kudos Nishant Sir. This is must read for all beiginer who want to enter market now.