We all know that inflation is a slow poison. It keeps eating your money slowly. Infact if we take average rate of 6%, inflation will double your costs every 12 years. So monthly budget is 50K will increase to 1L after 12 years, to 2L after another 12 years, 4L after another 12 years and so on. You get the picture right! Hence, it becomes very important to ensure that we find ways to beat inflation and protect our corpus. This article lists 7 ways to beat inflation and grow your money.

1. Finding alternatives to Saving Account and FDs

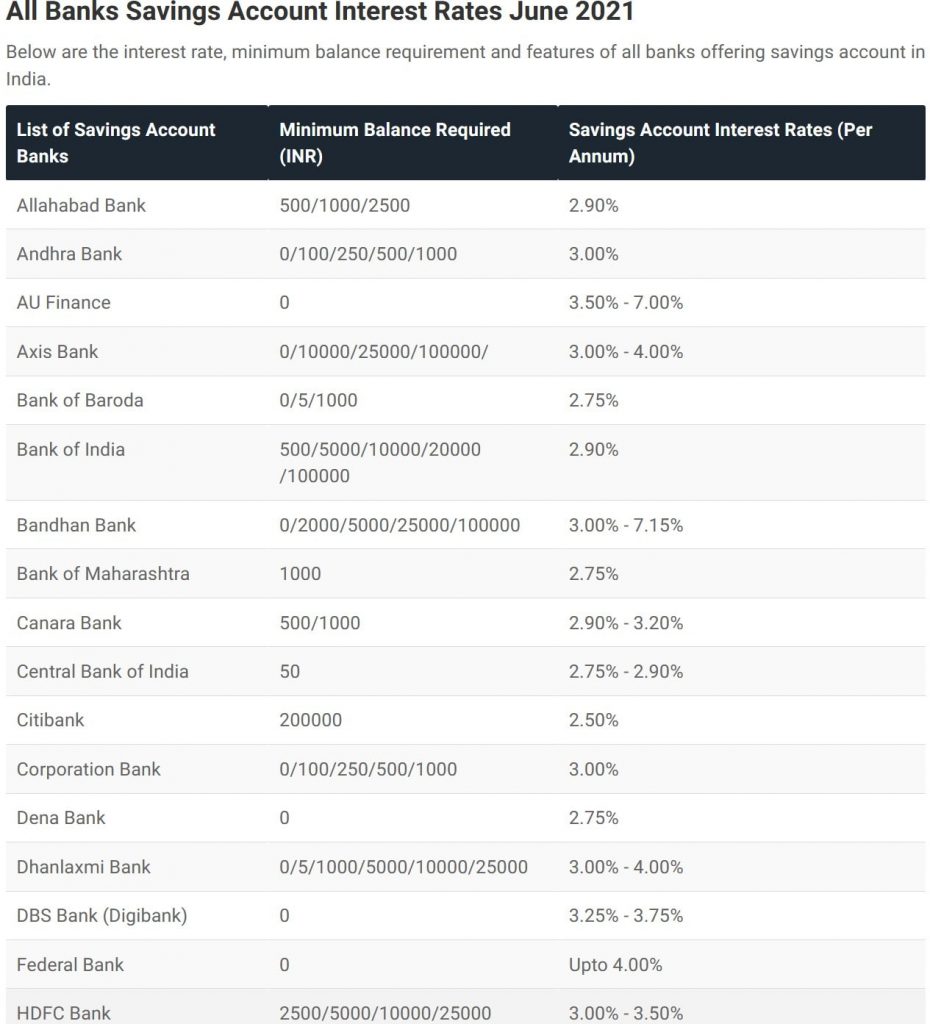

Let us face it. We all know that interest rates on Savings Account suck. Normally ranging between 2-4%, these accounts are worst place to park money. Still we all keep our money in savings account for fear of the unknown – we might need it for some emergency or we might loose it if we invest in markets and they crash. Few of us create FDs to try and earn higher returns. But most of the times, even they just match or are less than the inflation rate.

Current Covid crisis has further worsened the situation with bank reducing interest rates for both savings account and FD. Have a look at current interest rates in below two pictures.

Instead, an alternate way can be to park your money in liquid or hybrid funds. These are normally safer and give better returns than even FD.

Comparing across years, we can see that these funds have consistently given higher returns than Savings account or most of the FDs.

You might argue that these will lock the funds and we will not be able to use money in emergency. What if there is some emergency on Thursday night and I need the money. Money parked in mutual funds take about 3 working days to reflect in bank. That means I will not have money until Tue or Wed. How do I manage in such situation?

The simple answer to this is to use insurance, credit card and relatives/friends for emergency. I am hoping everyone will have medical insurance which will give cashless treatment to cover any medical emergency. For any other form of emergency, try using credit card. Avail a zero fee basic credit card which should be used strictly for such emergencies. If credit card is not accepted, then take help of family and friends.

2. Invest in markets

While above point suggested to invest your emergency / idle money in hybrid or liquid fund, this point is more focused on the investment money. Instead of investing in low return and safe products (endowment policies, ulips etc), invest in stocks if you understand them. If you do not understand how to analyze stock markets, opt to start SIPs in Mutual Funds. If you are confused between the huge number of mutual funds available in the market, invest in index based funds which replicate NSE and BSE. This way, you will be able to get better returns and beat inflation easily. Below pictures show the returns on Index Based funds.

3. Use NPS as an investment tool

If you are completely unaware of how to even find the right index based fund or find the process too complex, opt for NPS as a way to beat inflation. Select the auto allocation option which distributes proportion of money invested in E-C-G components automatically basis your age. Just keep investing regularly in this and wait to see the magic of your corpus growing and beating inflation.

4. Diversify your portfolio

One important way to beat inflation is to diversify your portfolio. Do not keep too many of same things.

A friend once confessed that he diversified his portfolio by investing in 5-6 large cap mutual funds of different companies. I simply explained that this is not diversification. If we look at the sector/stock weightage of these mutual funds, almost 90-95% would invest in same stocks and sectors. So there is no point having 5-6 mutual funds of same type.

Better diversification is to hold Stocks – MF (maybe 1-2 each of Large cap, mid cap, small cap depending on your goals duration and risk appetite) – Gold – Real Estate.

Usually it is seen that if stock markets crash, gold prices start increasing. So in bad times, if markets crash, you will atleast have other options to help you beat inflation.

Sensex vs Gold, both gain from 4,000 to 50,000 in last 21 years; yet, Sensex beats gold by about 50%

Source – Financial Express

5. Invest in products giving locked interest rates

Government has introduced schemes for senior citizens which give high interest and help in beating inflation. So schemes like Pradhan Mantri Vyay Vandana Yojna (PMVVY) and Senior Citizen Saving Scheme currently offer above 7% interest for a tenure of 5 years. That Is 5 full years of ignoring tension of inflation! Use these as a tool to defeat inflation.

6. Take help of Financial Planner

This is for all those who rely on Google and tips from friends and family members. Half baked information is always dangerous. Remember that everyone has different lifestyle, spending and saving habit, needs, requirement, goals. What suits them might not suit you.

Hence if you do not understand personal finance well or cannot manage it on your own, it is better to spend some money and take help from a good Financial Planner. It is wise to spend money now and enjoy comfortable life in future instead of saving money of Financial Planner now and repenting during your old age. After all, you only live once and don’t want your retirement years to be cash strapped.

Your finance planner should help you with a customized plan to beat inflation and meet all your goals.

7. Look for alternate avenues

You will constantly have to look out for new ways to beat inflation. Nowadays, Sovereign Gold Bonds are being sold by RBI. Calculations show them giving returns well over 10% which means they comfortably beat inflation.

The annualised performance of this SGB, as measured by XIRR (used to calculate the internal rate of return when the investment fetches periodical payments), was 17 per cent, while gold ETFs on an average generated 12 per cent annually.

Source – Business Line

Similarly, there are people (including me) who have invested in overseas property. Historical returns on such properties have consistently been in double digits and well above inflation.

Morale of the story is that with times, you have to keep looking for new avenues to beat inflation.

Hope you find my tips to beat inflation useful. Please share if you have any other tip. Looking forward to your comments and feedback 🙂

Liked this article? Join my Whatsapp group to be part of our community!

Other articles worth reading!

Also read – Old vs New Income Tax Slabs – Which one should you choose?Also read – Financial Booklet everyone should have

Another interesting article – Paytm First vs Amazon Pay vs Flipkart Axis Credit Card – Which is better

Feel free to share this article by clicking on the below icons…